You’ve probably read dozens of retirement planning articles online, bookmarked countless investment strategies, and maybe even attended a few seminars. But when you sit down to actually plan your retirement, you still feel overwhelmed. How much is really enough? What if the market crashes right when you retire? What happens if healthcare costs spiral out of control?

The internet is full of conflicting advice about retirement planning. One expert tells you to save 10 times your annual salary, another says 15 times. Some swear by index funds, others push real estate. Meanwhile, you’re left wondering which strategy actually works for people like you.

That’s where the right retirement planning approach makes all the difference. This guide will help you find a comprehensive strategy you can actually follow and show you how to document your financial journey so you can pass those hard-earned lessons on to the people you love most.

Key takeaways

- Retirement planning documentation goes beyond numbers to capture financial wisdom, values, and lessons that create a lasting family legacy.

- The best retirement guidance offers practical, actionable steps updated for modern challenges like longer lifespans and self-funded retirement accounts.

- Meminto Life Book transforms retirement planning from solo number-crunching into meaningful legacy creation through guided prompts and multimedia preservation.

- Professional features like speech-to-text, family collaboration, and Meminto Author support make documenting financial wisdom accessible regardless of tech skills or writing ability.

- Creating a retirement story preserves hard-earned financial lessons for future generations while providing personal reflection and clarity about your money journey.

Why retirement planning documentation matters

I used to think retirement planning was all spreadsheets and calculators. How much do I need? Should I max out my retirement savings? When can I afford to quit working? Then I started looking at how many people struggle financially in their later years despite having decent jobs their whole lives.

The problem isn’t usually that they didn’t save money. It’s that they had no system, no documented strategy, and no clear understanding of why they made the financial decisions they did. Without that foundation, even smart money moves can feel random and disconnected.

That’s when I understood that retirement planning isn’t just about the numbers. It’s about documenting the why behind your decisions and the lessons that took you years to learn. Without that context, even the smartest financial moves become just random data points.

Your financial journey tells a story

Every choice you’ve made with money tells a story, whether it’s deciding to keep driving that old car for two extra years so you could bump up your savings rate, or making an investment that seemed smart but taught you an expensive lesson about risk, or finally having that moment when you understood what compound interest actually means in real life.

These aren’t just random financial decisions but chapters in your family’s financial education. Maria from Germany figured this out when she started documenting her life story. “I initially wanted to document my life for my children. Thanks to Meminto’s insightful questions and prompt support, my story flourished into over 300 pages across two volumes.” she said.

Your retirement planning journey deserves the same thoughtful attention because those decisions you made, the research you did, and the mistakes you learned from could save your kids from making the same expensive errors.

Mistakes become valuable lessons

Most people have at least one financial decision they regret, whether you panicked during a market downturn and sold at the worst possible time, waited too long to get serious about saving because retirement seemed impossibly far away, or put too much money in one investment because it felt safe and familiar.

These aren’t embarrassing failures to hide but expensive education that could benefit someone else. When your kids are facing their first big market crash, wouldn’t you want them to know how you handled yours? When they’re debating major financial decisions, your experience could help them think it through, and the lessons you learned the hard way might be exactly what your family needs to hear.

Financial values matter more than formulas

You can find retirement calculators anywhere online, but what those calculators can’t capture is why you define “enough” the way you do, how your background shaped your relationship with money, or what financial security actually means to you personally.

Maybe you’re comfortable with market volatility because you’ve lived through several crashes and learned they always recover eventually, or you keep more cash on hand than the experts recommend because you value the peace of mind it brings.

These perspectives matter because they explain not just what you did with money, but why those decisions made sense for who you are. Your family needs to understand your financial personality, not just copy your investment strategy.

Legacy goes beyond inheritance

The greatest gift you can leave your family isn’t the account balance but the knowledge of how to handle money wisely. Your documented retirement journey becomes a roadmap for people who are facing financial decisions for the first time.

When your kids are trying to figure out if they can afford to buy a house, or when your grandchildren are learning about investing, they’ll have more than just money in the bank. They’ll have your thought process, your hard-learned wisdom, and your perspective on what really matters when it comes to financial security, and that’s the kind of inheritance that keeps giving long after the money is spent.

What to look for in a retirement planning book

I’ve probably read two dozen retirement planning books over the years, and most of them left me more confused than when I started. Some focus purely on investment strategies that assume you have a finance degree, others focus on lifestyle planning without addressing the money side, and a few try to cover everything but end up being so overwhelming that you never actually implement anything.

After wasting way too much time on books that didn’t help, I’ve figured out what actually matters when you’re trying to find guidance that works for your real-life situation.

- Practical, not theoretical

I’ve gotten burned by books that spend 200 pages explaining why compound interest is important without telling me exactly what to do with the money I have right now. The best retirement guidance gives you actionable steps you can implement immediately, like which specific accounts to prioritize, how to actually rebalance a portfolio, or what diversification looks like with real numbers and real investment options.

You already know saving for retirement is important. What you need is someone who assumes you’re smart enough to understand that and gets straight to the how, not the why.

- Updated for today’s reality

Retirement planning advice from 20 years ago assumed you’d have a pension, healthcare costs would be manageable, and Social Security would cover most basic expenses. That world doesn’t exist anymore for most of us, so guidance written for that reality will leave you completely unprepared.

Look for strategies that acknowledge modern challenges like longer lifespans where you might be retired for 30+ years, higher medical expenses that can wipe out solid savings plans, and the shift from employer-sponsored pensions to self-funded accounts where you’re responsible for everything.

3. Matches your knowledge level

A book written for investment beginners won’t help if you already understand portfolio theory and asset allocation, but advanced strategies about tax-loss harvesting can overwhelm someone who’s just trying to figure out the difference between a Roth and traditional IRA.

Be honest about where you actually are. If you’re starting from scratch, you need fundamentals explained clearly without feeling talked down to. If you’ve been investing for years, you want strategies that build on what you already know rather than rehashing basics.

4. Beyond the numbers

The most valuable retirement planning helps you think through what you actually want your retirement to look like, not just how to accumulate the biggest possible account balance. How will you handle the psychological adjustment of leaving your career? What will give your life meaning when work isn’t providing structure anymore? How do you plan for the possibility that your health or interests might change dramatically?

These aren’t touchy-feely extras but practical considerations that affect how much money you’ll actually need and how you’ll want to access it during retirement.

- Documentation and reflection

Look for approaches that encourage you to record your thinking, track your progress, and reflect on lessons learned along the way. As Werner from Germany found, “With just one question per week, I was able to record my life story. That was a lot of fun!” The best retirement planning becomes a journey of self-discovery, not just number-crunching.

When you document your decision-making process, you can look back and see what worked, what didn’t, and why you made certain choices. This turns your retirement planning into valuable wisdom you can share with your family instead of just a pile of financial statements.

- Comprehensive but focused

Effective retirement planning addresses the major areas like investments, healthcare, estate planning, and lifestyle considerations without trying to make you an expert in everything. You need enough depth to make informed decisions, but not so much complexity that you get paralyzed and never actually start.

The best guidance gives you frameworks for thinking about these big topics and helps you understand when you need professional help versus what you can handle yourself.

The best retirement planning book: Meminto life book

Most retirement planning books tell you what to do with your money, but they don’t help you figure out why you’re doing it or what you’ve learned along the way. You can read every strategy book ever written, but if you can’t explain to your family why you made certain choices or what mistakes taught you valuable lessons, all that financial wisdom dies with you.

Retirement planning isn’t just about spreadsheets and investment portfolios. It’s about documenting the wisdom you’ve gained, the decisions that shaped your financial future, and the lessons you want to pass on. The Meminto Life Book approaches retirement planning differently by helping you create a meaningful legacy project that preserves your financial journey for generations.

Here’s why Meminto Life Book stands out as the ultimate retirement planning companion:

Guided prompts for your financial journey

Instead of staring at blank pages, wondering where to start, Meminto provides thoughtful prompts that help you document your retirement story naturally. Questions like “What was your biggest financial mistake and what did it teach you?” or “How did your money mindset change over the years?” guide you through meaningful reflection that actually matters to your family’s future.

Jost from Germany shared, “It’s a great way to write everything down. A memoir like this also clarifies things for oneself.” Sometimes the process of documenting your financial journey helps you understand your own decisions better while creating something invaluable for the people you love.

| Traditional Retirement Books | Meminto Life Book |

| Generic advice for everyone | Personalized prompts for your story |

| Read once, shelve forever | A living document you build over time |

| Focus only on numbers | Captures values, lessons, and wisdom |

Multi-format memory preservation

Your retirement planning journey includes more than just written thoughts. Maybe you want to record a voice memo about why you chose certain investments after a particularly good or bad day in the market, or save a video message explaining your financial values to your grandchildren while you’re still healthy enough to share that wisdom clearly.

I’ve found that some of my most important financial insights come to me when I’m not sitting at a desk with a pen in hand. Sometimes it’s during a walk when I finally understand why a particular investment strategy makes sense, or during a conversation with a friend when I realize I’ve learned something valuable from a mistake I made years ago.

Meminto seamlessly integrates text, photos, audio recordings, and videos into one cohesive story that captures the full picture of your financial wisdom. Richard from the UK discovered, “I recorded my entire book, and Meminto transcribed it. It was simple and still led to something remarkable.”

This flexibility means you can capture insights the moment they happen, whether you’re sitting with old financial statements and remembering why you made certain choices, or explaining to your phone why you decided to change investment strategies after a major life event.

If you’re working with old family photos, check out our guide on Best AI Tools for Restoring and Colorizing Family Photos.

Perfect for any experience level

Whether you’re someone who still gets confused by all the investment jargon or you’ve been managing your own portfolio for decades, Meminto meets you where you are. The prompts adapt to your knowledge level, helping beginners think through basic concepts like why you chose a particular savings rate, while allowing experienced planners to dive deep into complex strategy decisions and the philosophy behind their approach.

What matters isn’t how sophisticated your financial knowledge is, but the wisdom you’ve gained from your own experience. The person who learned to save money by packing lunch every day for ten years has just as valuable a story as someone who developed a complex tax-loss harvesting strategy.

Professional writing support when you need it

For those who want extra help crafting their financial story, Meminto Author provides professional writing assistance and editorial support. Maybe you have decades of investment experience but struggle to organize your thoughts clearly, or you have powerful stories about overcoming financial challenges but need help making sure your wisdom comes across in a way that will actually help your family.

Whether you need help organizing complex investment decisions, polishing your writing style, or ensuring your financial lessons translate into practical guidance, professional writers can collaborate with you to create something truly exceptional. This service bridges the gap between DIY documentation and professional memoir writing, giving you your authentic voice with professional polish when you want it.

Compare our approach with other platforms in Meminto vs StoryWorth: The Best Alternative.

Legacy creation, not just planning

Traditional retirement books help you plan for your own future, but they don’t help you think about what happens to all that knowledge and experience you’ve accumulated. Meminto Life Book helps you create a financial legacy for your family that goes far beyond whatever money you leave behind.

Willi from Germany understood this: “I wrote my Meminto Stories book mainly as a keepsake for my grandchildren and great-grandchildren. Not only was it a breeze to do, but it was a lot of fun.”

Your financial decisions tell a story that goes far beyond account balances and investment returns. They reflect your values, your hard-learned lessons about risk and reward, your mistakes that taught you more than any book ever could, and your hopes for the people you care about most. That story is often more valuable than the actual inheritance.

See how other families approach legacy creation in Best Baby Memory Book for Boys and Girls.

Key features:

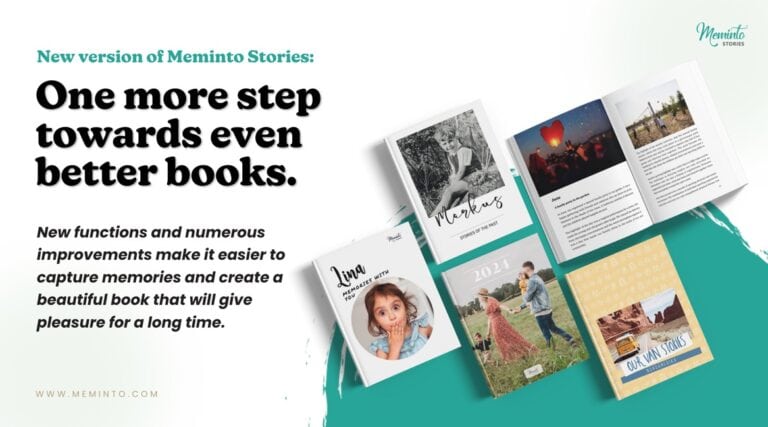

- Weekly prompts keep you engaged without overwhelming, which I’ve found makes the difference between actually doing it and giving up after a few weeks. Instead of staring at a blank page wondering what to write about, you get one simple question that helps you think about a specific part of your money journey.

- Speech-to-text makes it easy for everyone, so even if you’re not good with typing or prefer talking through your thoughts, you can still capture your story. Richard from the UK used this feature and found it completely changed how he got his experiences down on paper.

- Professional hardcover printing creates something that lasts and that your family will actually want to keep and look at, not just another computer file that might get lost. There’s something special about holding a real book that has all your financial wisdom in it.

- Family collaboration features let your loved ones add their thoughts too, which often brings up details and ideas you might have forgotten. Sometimes your spouse remembers why you made certain money decisions better than you do, or your kids can share how your approach to money affected their own choices.

- Meminto Author service available for professional writing help means you can get support organizing your thoughts or making your story better if writing isn’t your thing, but you still want to create something great for your family.

No overwhelming complexity

I’ve tried reading those huge retirement books that promise to answer every money question you could ever have. They usually end up sitting on my shelf, half-read, because they try to cover so much that I get lost in all the details and never actually do anything with what I learned.

Meminto help you break your financial story into manageable weekly prompts instead of expecting you to write a huge paper on retirement planning. You’re simply thinking about your journey one memory at a time, which makes the whole thing feel natural rather than like work.

Werner from Germany had exactly this experience: “With just one question per week, I was able to record my life story. That was a lot of fun!” The process becomes something you enjoy rather than another task on your list.

Meminto Life Book turns your financial wisdom into a family treasure that will help and inspire long after you’re gone, changing retirement planning from just personal preparation into creating something lasting for the people you love.

For more platform comparisons, see Remento vs Meminto: Best Remento Alternative.

Start your retirement legacy today

Creating your retirement legacy book with Meminto works the same way thousands of other people have documented their life stories, using a guided approach that makes capturing your financial journey and retirement wisdom as simple as answering one thoughtful question each week.

I know it can feel overwhelming to think about documenting decades of financial decisions and lessons learned, which is exactly why the weekly prompt system works so well. You’re not trying to remember everything at once or figure out where to start but just answering one question about your money journey, and over time those individual responses build into something meaningful.

For a complete step-by-step guide on using Meminto to create your life story book, including tips for organizing your thoughts, making the most of the guided prompts, and adding photos or audio recordings, visit our guide on How to Write Your Life Story: A Step-by-Step Guide.

Ready to begin preserving your retirement story? Start your Meminto Life Book today and turn your financial journey into something your family will treasure long after you’re gone.